|

USENIX Technical Program - Paper - Smartcard 99

[Technical Program]

Which Security Policy for Multiapplication Smart

Cards?

Pierre Girard

Cryptography and Security R&D

GEMPLUS

Parc d'activité de Gémenos - B.P. 100

13881 Gémenos CEDEX - France

Pierre.Girard@gemplus.com

In this paper, we aim to clarify some issues regarding the deployment

context of multiapplicative smart cards. We especially deal with the

trust relationships between the involved parties and the resulting

constraints from a security point of view.

We highlight a new security threat in a multiapplicative context and

propose a new multilevel security model which allows to control

precisely the information flows inside the card, and to detect illegal

data sharing.

Finally we illustrate all the proposed concepts on an multiapplicative

example involving three applications.

Introduction

Multiapplication smart cards are getting more and more attractive for

numerous good reasons. Users are willing to reduce the number of cards

in their wallets, issuers want to decrease the time-to-market, the

development, infrastructure and deployment costs or to update/add

applications after card issuance. In addition multiapplication smart

cards allow commercial synergies between partners and can lead to new

business opportunities. A credit card with an electronic purse and a

frequent flyer application is a classical example of a

multiapplication smart card.

A few operating systems have been proposed to manage multiapplicative

smart cards, namely Java Card1, Multos2 and more recently Smart Card for

Windows3. In

this paper we will focus on Java Card and exhibit examples for this

platform, but all the results can apply to any multiapplicative

platform.

Security is always a big concern for smart cards, but the issue is

getting more intense with multiapplicative platforms and post issuance

code downloading. Of course, Java Card security or protection against

aggressive applets have been discussed extensively, but we still lack

a global security policy for multiapplicative smart cards. We will

show that this kind of policy must be more than the simple

concatenation of the security policy of all applications. Until now,

this topic hasn't been appropriately investigated, probably because

numerous issues concerning how those cards will be used remain

unclear: which parties will cooperate? how? which of them will drive

the scheme? etc.

In this paper we first aim at clarifying those issues. Next, we show

that there is a need for a card-wide security policy, mainly because

of the existance of information sharing mechanisms between applets.

Then, we propose a new security policy to deal with this need and show

an example of how it could be used. We finish with limitations,

potential extensions and related work.

The multiapplication platform

On a multiapplication platform, we usually find an operating system

managing the card resources (like I/O, memory, random number

generator, crypto engine...) and some applications (possibly loaded

after the card issuance) from various sources using the OS services.

In addition, the OS ensures application segregation and provides

mechanisms to allow controlled data sharing between applications.

Which participants?

Unlike single-application smart cards, multiapplication smart cards

involve many participants. Of course, there are still an issuer and an

end user, but additional third parties which can interact directly or

not with the card are also involved.

To separate precisely the actions of the participants we have defined

two roles in addition to the usual issuer which is played by a unique

authority: the application provider and the card operator.

The application provider designs an application for the targeted card

operating system and negotiates with the issuer for downloading its

application inside the card (before or after the card issuance). It's

the owner of the applet and applet's data. Of course, the issuer

itself will place some applications inside its card, and will play the

application provider's role.

The card operator is an entity which can interact with the card either

to use an application or to perform administrative tasks. An

administrative task can be anything from auditing the card or updating

a key to downloading a new application. The interaction between the

operator and the card can be direct (e.g. if the card is inserted in

an ATM) or remote (e.g. through the Internet or a cellular phone

network). It is likely that the application providers and the issuer

will play the operator's role as well. Conversely, an operator will

probably be an application provider, even if it could be delegated to

interact with an application of another provider. An applet can be

designed to work with one operator (likely its owner) or more. In

this case its behaviour could differ according to the operator.

Coming back to the example of a credit card with a frequent flyer

application, we can assume that the issuer will be a bank, which will

also be the application provider and the operator of the credit

applet. An air travel company will be the provider and the operator

of the loyalty applet. Some other companies can join the loyalty

program and become operators for the loyalty applet.

The first and the simplest way to operate such a multiapplication

platform is to keep it entirely under the control of the issuer. It

will be the only authority responsible for the card and its

integrity. All application providers must negotiate and agree with the

issuer conditions and guidelines for downloading their applications on

the card. The issuer is granted all possible rights in the card and

will enforce its policy during all the card life, as well as inspect

applications carefully before downloading them. In the rest of the

paper we suppose this mode of operation as it seems to be the most

likely in the forthcoming years. However, other ones like the two

following could exist.

One can imagine a second model where the end user buys a blank card

from a manufacturer of its choice and plays the issuer's role.

Afterwards, it will accept or buy from providers some applications for

its card. The whole card will be (or should be) under its control. We

do not consider this scenario as it is unclear if providers will

accept to download their applications into cards for which they have

no or few behaviour guarantees. Probably, this type of scheme will

coexist with the first one, but for non security critical applications

or for applications totally operated by the end user. For example, a

manufacturer of smart locks using smart cards, instead of keys, could

propose to download its application on users cards. The users could

decide to buy an ad hoc card or use an existing one to put the

application driving the smart lock.

A third type of scheme adds another role: certification authorities.

Those authorities will audit issuers and their cards and will provide

a certification which will guarantee that an issuer respects a given

policy. Based on this policy a provider as well as an end user will be

able to decide if the issuer's policy complies with their

requirements. An example of certification could be a ``privacy

awareness'' label for issuers which respect the privacy rights of the

users and do not leak private data outside the card. This is a

refinement of our first scheme and we won't focus on it in the

following.

At first glance, it is easy to see that there are, at least, two

separate security problems: the platform level security and the

application level security.

The first one (platform level security) concerns applications

segregation (this can be viewed as the classic OS security) as well as

the quality of security services offered by the platform (e.g.

correctness of the Java virtual machine including the verifier, tamper

resistance, cryptographic algorithms and post-issuance loading

mechanism). This part is under the issuer's responsibility.

The second one (application security), is under the provider's

responsibility, but relies necessarily on the platform security.

Moreover, the application should assume that the OS won't be

aggressive and will act as it is supposed to. Conversely, the OS

doesn't make any assumption about the application and should still

work and protect the other applications even if an aggressive or

unsecure piece of code is loaded. However, one should note that even

if this is technically perfectly acceptable, and if an unsecure

application can't threaten the platform or other application, the end

users or potential customers could get confused by a break-in of an

application and mixed up the platform security and the application

security. To avoid this potential damage to its brand image, an

issuer could enforce a minimum security level for the applications

loaded on its card by reviewing them or operating a scheme including

some certification authorities.

Apart from these two obvious security aspects, a third one must be

addressed. All the difficulties arise from data sharing inside a

card. Actually, most of multiapplication smart cards, in order to

build cooperative schemes and optimize memory usage, allow data and

service sharing (i.e. objects sharing) between applications. And

beyond this point there is a need for a card-wide security policy

concerning all the applications. A small example should make this

point clearer. When an application provider A decides to share (or

more probably to sell) some data with an application provider B, he

will ask for guarantees that B won't be able to resell those data or

make them available world-wide.

To address these problems two kinds of security policies can be

introduced: a discretionary one and a mandatory one. The applications

will be in charge of defining their own discretionary security policy

which could be enforced by the OS. For an example, in a Java card, an

applet can decide to share some of its objects with a selective list

of other applets. On this access control list basis, the OS will allow

or deny access to the shared object by other applets. If we just

consider a discretionary policy, nothing prevents an application B

which could legally access an object of A (B has been granted from

A to read the data) from copying the information into another object

shared with C. In this case the information is transfered from A

to C even if C is not granted access the information from A.

A mandatory security policy is necessary to solve the problem of

re-sharing shared objects as pointed above. Actually none of the

existing OS enforce such a policy.

In this paper, we will discuss this last point and propose a security

model, compliant with the requirements of safe data sharing and able

to control the information flows inside the card.

In the following we consider the threat of an insecure or malicious

applet gaining legally some access to sensitive data (by a sharing

mechanism of the OS) but resharing them illegally with a third party.

The threat could be a commercial concern (as in the previous example)

or privacy concern. This later case is especially important when

dealing with health-care cards containing medical records or with

loyalty cards containing marketing profiles.

A new security model

The security policy enforced by the OS should model the information

flows between the applications which, themselves, reflect the trust

relationships between the participants of the applicative scheme. In

this section we will start by studying the trust relationships, then

the security model, and finally consider some implementation issues.

In the basic situation the only trust relationships are from everyone

to the issuer, as there is no way for a participant to distrust the

issuer. The platform OS is completely under the issuer's control and

is potentially able to read, write, create or modify everything on it

including the applications and their keys.

In addition, some participants can trust other ones: sometimes because

it is in fact the same entity which plays more than one role and

sometimes because there is an agreement or a contract between the two.

It should be noticed that the trust relationship is neither symmetric

nor transitive: an entity wouldn't like to trust someone only because

one of its partners trusts it. This situation is not likely to change

as cooperation in industry becomes something more complex and subject

to daily change (one could speak about coopetition between companies

as well as between divisions inside a company).

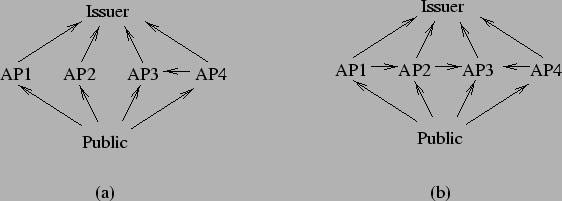

Figure 1 shows an example of trust relationships with

four applications providers and three operators. The issuer trusts

no-one except OP1 and AP1 which are two roles played by the issuer

itself. We can see that AP1 trusts AP2 and AP2 trusts AP3 which

doesn't mean that AP1 trusts AP3.

Figure 1:

Example of a trust relationship

|

|

We can also note that AP4 doesn't operate its applet itself but relies

on, and thus trusts, OP3 to do so.

Now, it should be clear that a mandadory security policy must be

enforced in a multiapplicative scheme which will allow or deny data

flows between applications given the trust relationships. If an entity

A trusts an entity B, this means that some information could flows

from A to B. We have chosen a classic multilevel security policy

using a set of security level modelling the trust relationships.

The multilevel security policy, first modelled in [2], uses

a set of security levels with a complete lattice structure. A

security level is associated to each subject (an entity manipulating

information) and each object (a piece of information but not an object

in object-oriented programming sense) of the system. The lattice

structure implies an order relation on the set, and hence that the

relation is transitive.

The security rule states that a read (resp. write) access by a subject

to an object is granted if and only if the level of the subject is

greater (resp. lower) or equal to the object's level. The classical

example of a multilevel security policy is the document classification

inside a military organisation. In this case the set of security level

is: {Unclassified, Confidential, Secret, Top secret} with a

usual order between the security levels.

We will now consider how to map each entity and information in a

multiapplicative scheme to a security level. First of all we will

create one level associated to the issuer and one associated to each

application provider. If an operator and an application provider trust

each other they will be represented by only one level.

To establish a multilevel policy for a card without data sharing, one

can choose a (non flat) lattice of security levels with one level for

each application provider and an additional public level to complete

the lattice. Figure 2 indicates the security level

lattice corresponding to the example of figure 1, part

(a), where an arrow represents an order relation between two

levels. In this case, the only legal information flow is from a public

level to the issuer through any role, but communication between

providers or operators is strictly prohibited except from AP4 to AP3

because AP4 trusts OP3 and because OP3 and AP3 have been merged.

Figure 2:

Example of security level lattice without

sharing (a) and with an unacceptable sharing (b).

|

|

To allow data sharing between entities, one cannot simply allow a new

order relation between two roles as we cannot accept the transitivity

effect of the order relation. As an example, if AP1 from our last

example wants to share some data with AP2 and AP2 wants to share data

with AP3, the security lattice of figure 2, part (b) is

clearly inadequate. We recall that the trust relationship is not

transitive and so AP1 does not want to share data with AP3 which is

possible with this solution through AP2.

To solve this problem we propose that AP1 and AP2 agree on a data

subset they want to share. Those data will be classified with a new

level called AP1+AP2 placed in the security level lattice shown on

figure 3. The same agreement will take place between

AP2 and AP3 resulting in another level AP2+AP3.

Figure 3:

Example of security level lattice with

acceptable sharing

|

|

This technique can be refined if there is a need for sharing a subset

of AP1+AP2 with AP3. We will create a new level called AP1+AP2+AP3

greater than the public level but lower than AP1+AP2 and AP2+AP3.

To enforce the latter policy within a card (we consider here a Java

Card), a lot of implementation issues should be considered. First of

all, we should decide which data will be classified, and with which

granularity. We should also consider the implementation of security

mechanisms which will enforce the policy.

The classification of objects in object oriented language is a complex

problem (see [5] for a recent discussion on this subject),

however, we can chose a simple strategy by assigning a security level

to each object instance. In a given applet, the objects will be

labelled with their provider's level except if an object is shared, in

which case, we will choose the level related to shared data. The

authorized information flows in an applet will be from lower labelled

objects to higher ones.

Enforcing the security policy could be done dynamically by a reference

monitor (part of the card OS) which will be called each time an object

reference is used by the virtual machine or statically by checking the

correctness of the information flows in an applet. The first solution

would be too costly in memory and execution time which are both

critical in a smart card as we shoud tag each object with its level

and check the validity of each read/write operation.

The second solution has been studied for a long time (Denning

pioneered this domain [6] and was followed by [8,1,11,4]) and could be integrated to existing static

verifier of Java bytecode. Using security level set with a lattice

structure is a key point to guarantee that the static analysis will

terminate.

Practically, this means that an applet provider will deliver its code

to the issuer along with the security level of all the objects

contained in it. The issuer will verify that the code and the declared

levels of the objects comply with the other applets and their objects

security levels.

A real world example

We present in this section the example of a multiapplicative

healthcare card. This card is issued by a health insurance with an

applet. This applet contains some administrative data including the

social security number of the card holder.

In addition, the user has joined the loyalty program of a drugstores

chain and downloaded the corresponding applet. The drugstore applet

can use the social security number and contains some administrative

data and, possibly, a few medical records (e.g. medication

allergy). It also contains a loyalty part which maintains a loyalty

points counter.

The third applet on the user's card is a loyalty applet of a sport

centers chain which has an agreement with the drugstores chain and

shares the loyalty point counter with the drugstore applet.

Figure 4 summarizes the information flow between the

applets.

Figure 4:

Example of three applets sharing data

|

|

The drugstore applet can read the social security number, but is not

allowed to give it to other applets. The security threat is the

following: the drugstore applet can copy the social security number

from the healthcare applet to the loyalty point counter and broadcast

it to applets allowed to read the counter.

To face this threat, we propose a mandatory security policy using the

security level lattice of figure 5. All the objects of

the healthcare applet will be labelled with HC except the social

security number labelled with SSN. The objects of the drugstore

applet are labelled with the DS level except the loyalty point

counter which is labelled with PTS. Finally, all the objects of the

sport centers chain applet are labelled with SC.

Figure 5:

Lattice of security levels for figure

4 applications

|

|

This way, if the drugstore applet copies the social security number in

one of its objects (labelled DS) and later in the loyalty point

counter (labelled PTS), an illegal information flow will be detected

as PTS is lower than DS and information can only flow from a lower

level to a greater one.

To be more complete, we should deal with the external world: the

drugstore applet can exchange some data with an operator. The external

software used by the operator should also be checked to verify that it

doesn't content a covert channel transfering information from the DS

level to the PTS level.

As this software can be modified, the issuer can also ask the

drugstore applet provider to encrypt the social security number before

sending it outside the card.

The limitations of our work clearly come from the communications with

the external world. We are currently improving this point of the

security model. We are also in the process of implementing static

verifiers of applets as well as including declassification processes

(e.g. when the data flow through a ciphering filter) in the security

model.

Some authors have already dealt with non-transitivity constraints in

different contexts [10,3], but we are not aware of a

multilevel security policy applied to a smart card and its

environment. A lot of papers dealing with classic Java Card security

are available. We refer the reader to recent publications like

[9] or [7] for a complete bibliography.

Conclusion

In this paper, we clarify some issues around the operating scheme of

multiapplicative smart cards and highlight some new security threats.

The proposed multilevel security model allows us to control precisely

the information flows inside the card, and detect illegal data

sharings.

In a next step, analysing tools should be developed and provided to

issuers which will be able to audit applets proposed by third parties

for their cards.

- 1

-

Jean-Pierre Banâtre, Ciarán Bryce, and Daniel Le Métayer.

Compile-time detection of information flow in sequential programs.

In Dieter Gollmann, editor, Proceedings of ESORICS, number 875

in LNCS, pages 55-73. Springer, November 1994.

- 2

-

D. Bell and L. Lapadula.

Secure computer systems : Unified exposition and MULTICS

interpretation.

Technical report ESD-TR-75-306, MITRE Corporation, 1975.

- 3

-

Pierre Bieber.

Formal techniques for an ITSEC-E4 secure gateway.

In Proceedings of the Twelfth Annual Computer Security

Applications Conference, December 1996.

- 4

-

J. Cazin, P. Girard, C. O'Halloran, and C. Sennett.

Formal validation of software for secure systems.

In Formal Methods, Modelling and Simulation for System

Engineering, Saint-Quentin-en-Yvelines, February 1995.

- 5

-

Frédéric Cuppens and Alban Gabillon.

Rules for designing multilevel object-oriented databases.

In Jean-Jacques Quisquater and al., editors, Proceedings

of ESORICS, number 1485 in LNCS, pages 159-174. Springer, September 1998.

- 6

-

Dorothy E. Denning and Peter J. Denning.

Certification of programs for secure information flow.

Communication of the ACM, 20(7):504-512, July 1977.

- 7

-

Jean-Louis Lanet and Antoine Requet.

Formal proof of smart card applets correctness.

In Jean-Jacques Quisquater and al., editors, PreProceedings of CARDIS, Louvain-la-Neuve, September 1998.

- 8

-

Maasaki Mizuno and David Schmidt.

A security flow control algorithm and its denotational semantics

correctness proof.

Formal Aspects of Computing, 4:727-754, 1992.

- 9

-

Joachim Posegga and Harald Vogt.

Byte code verification for java smart cards based on model checking.

In Jean-Jacques Quisquater and al., editors, Proceedings

of ESORICS, number 1485 in LNCS, pages 175-190. Springer, September 1998.

- 10

-

John Rushby.

Noninterference, transitivity, and channel-control security policies.

Technical Report CSL-92-02, SRI, December 1992.

- 11

-

Dennis Volpano and Cynthia Irvine.

Secure flow typing.

Computers and Security, 16(2):137-144, 1997.

Which Security Policy for Multiapplication Smart

Cards?

This document was generated using the

LaTeX2HTML translator Version 98.2 beta6 (August 14th, 1998)

Copyright © 1993, 1994, 1995, 1996,

Nikos Drakos,

Computer Based Learning Unit, University of Leeds.

Copyright © 1997, 1998,

Ross Moore,

Mathematics Department, Macquarie University, Sydney.

The command line arguments were:

latex2html -split 0 camera-ready.tex

The translation was initiated by Pierre Girard on 1999-04-06

Footnotes

- ... Card1

- See

http://java.sun.com/products/javacard.

- ... Multos2

- See

http://www.multos.com.

- ...

Windows3

- See http://www.microsoft.com/smartcard.

Pierre Girard

1999-04-06

|